Tokenization is revolutionizing how we represent and interact with assets, fundamentally changing ownership, access, and trading. It’s a process that leverages blockchain technology to transform real-world assets into digital tokens, opening up a world of new possibilities. Understanding this process is crucial for navigating the evolving landscape of finance and technology.

1. Introduction to Tokenization

1.1 What is Tokenization?

Tokenization is the process of representing something of value – be it a physical asset like real estate or a digital asset like intellectual property – as a digital token on a blockchain. This token acts as a verifiable and transferable representation of the underlying asset, offering a secure and transparent way to manage and trade it. Think of it as digitizing ownership and making it easily tradable on a decentralized platform. This is different from simply digitizing a record; tokenization creates a digital asset with its own inherent value and transferability. The process involves careful consideration of legal and regulatory frameworks to ensure compliance.

1.2 The Basics of Tokens

Tokens are cryptographic units of value, stored and transferred on a blockchain network. They represent a claim or ownership stake in an asset, enabling fractional ownership and easy transfer. Understanding how tokenization works in blockchain technology requires understanding the underlying blockchain’s properties: immutability and transparency. These properties ensure the integrity and traceability of token transactions, enhancing trust and security. Different types of tokens exist, each with its own functionality and characteristics.

1.3 Types of Tokens (Utility, Security, etc.)

The difference between security tokens and utility tokens on blockchain is significant. Security tokens represent an investment in a company or asset, offering rights and obligations similar to traditional securities. They are subject to strict regulations. Utility tokens, on the other hand, provide access to a product or service within a specific ecosystem. They don’t represent ownership or investment. Other types include governance tokens, which grant voting rights within a decentralized organization (DAO), and NFT (Non-Fungible Tokens), unique tokens representing ownership of a specific digital or physical item. Choosing the right type of token depends heavily on the goals and nature of the underlying asset.

2. Tokenization and Blockchain Technology

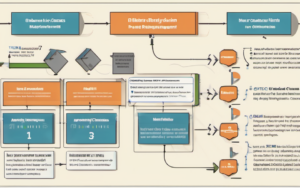

2.1 How Blockchain Enables Tokenization

Blockchain’s decentralized, secure, and transparent nature makes it the ideal platform for tokenization. The immutable ledger ensures that all token transactions are recorded permanently and verifiably, minimizing the risk of fraud and double-spending. The distributed nature of the blockchain enhances security by eliminating a single point of failure. This is particularly important for assets such as real estate, where transparency and security are paramount. The tokenization process for real estate on blockchain involves creating tokens that represent ownership shares of a property.

2.2 Smart Contracts and Token Functionality

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automate the execution of tokenized transactions, improving efficiency and reducing the need for intermediaries. Smart contracts can automatically manage the transfer of tokens, enforce compliance with pre-defined rules, and distribute dividends, making the entire process more streamlined and secure. This automation is a key benefit of tokenization, reducing reliance on traditional, often slow and expensive processes.

2.3 Decentralized Exchanges (DEXs) and Token Trading

Decentralized exchanges (DEXs) allow for the peer-to-peer trading of tokens without the need for a central intermediary. This increases liquidity and reduces reliance on centralized platforms, which can be susceptible to hacking or manipulation. DEXs provide a more transparent and efficient marketplace for tokenized assets, increasing their accessibility and facilitating more rapid trading. The security considerations for tokenization on blockchain are crucial, as any vulnerability can lead to significant losses.

3. Use Cases of Tokenization

3.1 Real-World Applications of Tokenization

Tokenization is finding applications across numerous sectors. Tokenizing assets, such as real estate or art, allows for fractional ownership and easier trading. This is particularly beneficial for illiquid assets, unlocking greater liquidity and attracting a wider range of investors. Fractional ownership, enabled by tokenization, allows for greater participation in previously inaccessible markets. Supply chain management benefits from tokenization through enhanced tracking and verification of goods, boosting transparency and reducing the risk of counterfeiting.

3.2 Tokenization in Different Industries (Finance, Healthcare, etc.)

The finance industry is already seeing significant adoption of tokenization, improving efficiency and transparency in areas like securities trading and lending. Healthcare could leverage tokenization for secure data management and patient record sharing. Other industries, such as supply chain management and digital identity, also stand to benefit from the increased efficiency and security provided by tokenization. The benefits of tokenizing assets on blockchain are numerous, leading to a wider adoption across various sectors.

4. Benefits and Challenges of Tokenization

4.1 Advantages of Using Tokenized Assets

Tokenized assets offer increased liquidity and efficiency due to their ease of trading and divisibility. Enhanced transparency and security are also significant advantages, as all transactions are recorded on a public and immutable ledger. Reduced transaction costs compared to traditional methods are another compelling benefit, making tokenization an attractive alternative for numerous applications. These benefits contribute to greater efficiency and reduced friction in financial markets.

4.2 Potential Drawbacks and Risks

Despite its numerous advantages, tokenization faces challenges. Regulatory uncertainty surrounding the legal status of tokens remains a major obstacle in many jurisdictions. Security risks and vulnerabilities, including smart contract exploits, are also a concern that needs to be addressed with robust security measures. Scalability issues, especially when dealing with a large number of transactions, also present a challenge for widespread adoption. Addressing these challenges is crucial for the continued growth and success of tokenization.

5. The Future of Tokenization

5.1 Emerging Trends in Tokenization

We are likely to see further innovation in tokenization technologies, including the development of more sophisticated smart contracts and improved interoperability between different blockchain networks. The integration of tokenization with other emerging technologies, such as the metaverse and decentralized finance (DeFi), is likely to accelerate its adoption. This will lead to even more efficient and secure systems for managing and trading assets.

5.2 Potential Impact on Various Sectors

Tokenization’s potential impact on various sectors is vast. It can transform industries by increasing efficiency, transparency, and accessibility to assets. From supply chain management to digital identity, tokenization can revolutionize how we interact with assets and data. The transformative power of tokenization is undeniable, and its potential applications are still being explored. This ongoing innovation will undoubtedly continue to shape the future of finance and technology.

The transformative power of tokenization is reshaping how we think about ownership, value, and exchange. Its potential to streamline processes, increase transparency, and enhance security across various sectors is profound. As regulations evolve and technology matures, we can expect even more widespread adoption and innovation within the tokenization space, leading to an increasingly decentralized and efficient global economy.